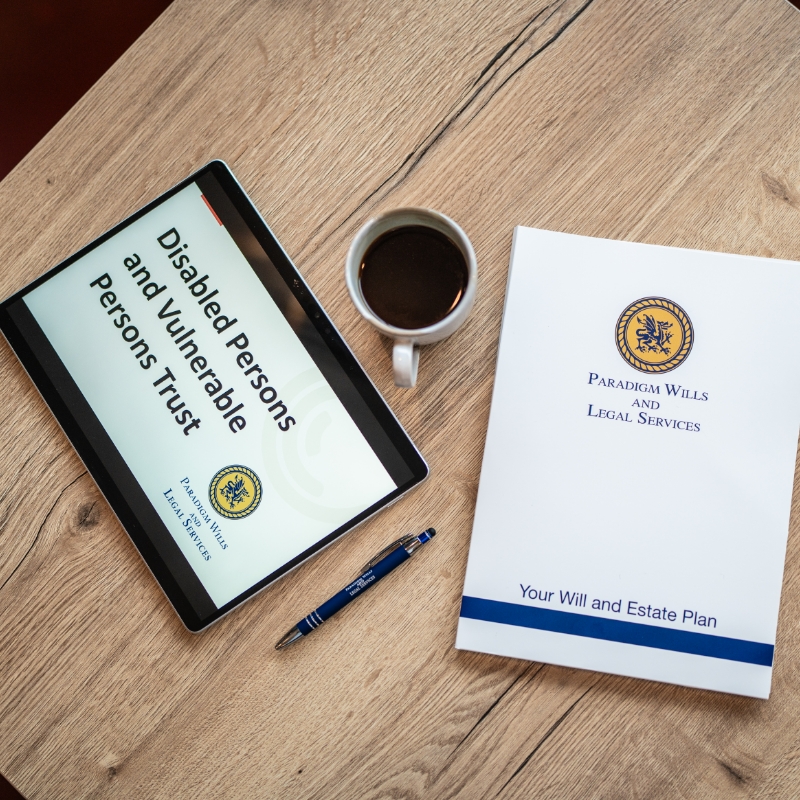

Disabled Persons and Vulnerable Persons Trust

For vulnerable individuals unable to take care of their financial affairs, the Disabled Person’s Trust can provide your chosen beneficiaries with financial stability throughout their lifetime and protect them from the risk of exploitation and financial abuse.

At Paradigm Legal Services, we can set up a trust to safeguard the financial future of your disabled children or people in your life, with their best interests at heart.

What are the benefits of a Disabled Person’s Trust?

Their benefits will be unaffected.

Often disabled people are eligible for means-tested benefits such as income-based jobseeker’s allowance, income-related employment, or disability allowance. One of the most valuable benefits of the Disabled Person’s Trust is that whilst your inheritance is in the fund, your assets will not belong to your named beneficiary, nor will they receive the inheritance outright. Therefore, it is not factored into any means test carried out in determining the amount or continuation of disability benefits. The payments your disabled beneficiary receives from the trust will not affect their benefit entitlement or support package.

Secure a good quality of life for your child.

Although your chosen beneficiary does not receive the inheritance outright, money or other assets left in the trust will help to maintain your child’s future quality of life. Without the trust, their allowance could be seized, and their assets taken by the local authorities to pay for benefits. Instead, the DPT gives your appointed trustees the responsibility of distributing your assets. With a letter of your wishes, your trustees can manage how the income in the trust fund is used, including when and how much funds they distribute to the child. Ultimately, the DPT offers you peace of mind that your trusted person will look after your child after your passing.

Favourable tax treatment.

If the DPT meets certain prescribed conditions, the disabled person could be excluded from incurring inheritance tax, income tax and capital gains tax charges that would otherwise have to be paid. For disabled persons above 65 (state pension age), an ‘attendance allowance’ can be a benefit.

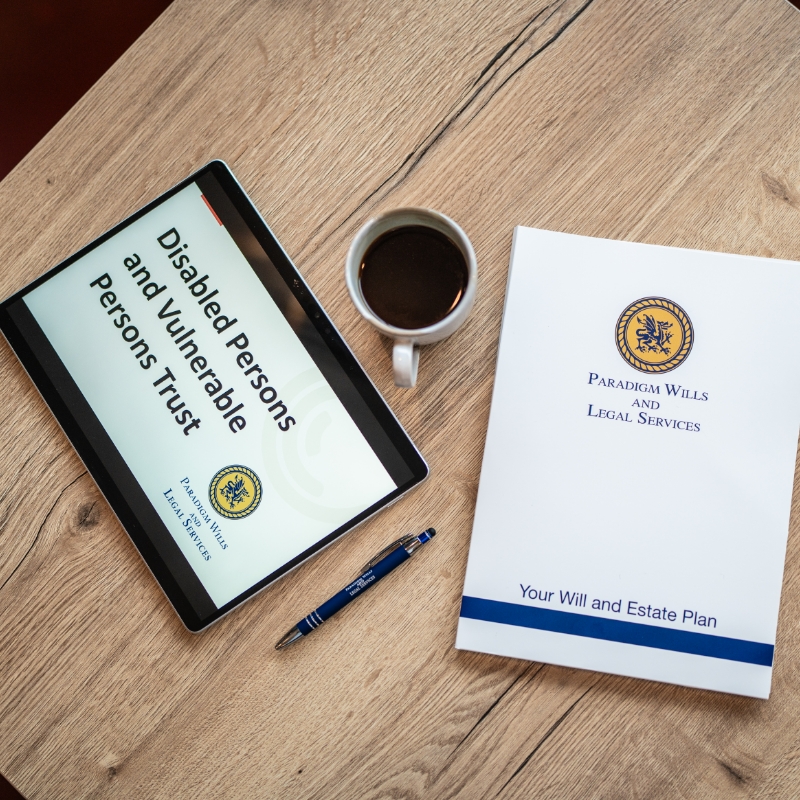

With our continued support, we free you from the burden of worry and provide you with peace of mind that your assets will be inherited by your loved ones when you are no longer here.

At Paradigm Wills and Legal Services, we genuinely care about educating people on the importance of making a will. In an industry often loaded with complex legal jargon and a conveyor-belt mentality, we provide a paradigm shift in how we offer our wills services. We aim to supply fresh ideas, clear and straightforward explanations, and a service tailored specifically to you. With you at the centre, we strive to make the will writing process as transparent as possible.

Contacting us is free. Have a consultation or a home visit with one of our experts and discuss your options with no obligation.

Our experienced legal advisors are on hand to provide you with all the advice you need with writing a Will, guidance on establishing a trust, help with applying for probate, and arranging prepaid funeral plans.

Get in touch

You may want to talk through your options first with our team of legal advisors. Fill out our form and the team will contact you to help you with everything you need to get started.

Protective Property Trust

Are you a joint homeowner? Do you have concerns about who will inherit your share of the residence? Find out more about protecting yourself, your partner, and your estate.

Flexible Life Interest Trust

Do you want to ensure that your surviving spouse will have an income for the rest of their life? Find out more about how to provide for your partner with income from the trust and avoid inheritance tax.

Asset Protection Trusts

Do you want to ensure that all your assets will ultimately pass to your children? Find out more about creating a living trust that allows you to transfer your assets or property immediately.

Discretionary Trust

Are you concerned about the potential misuse of your assets? Find out more here about creating a trust which gives you control over when and how much your beneficiaries inherit.