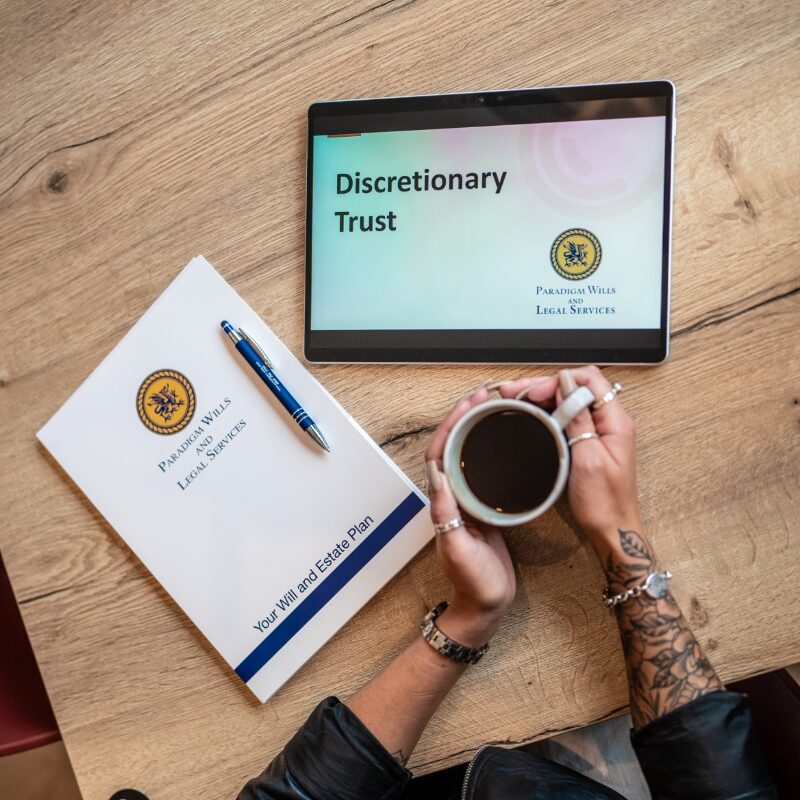

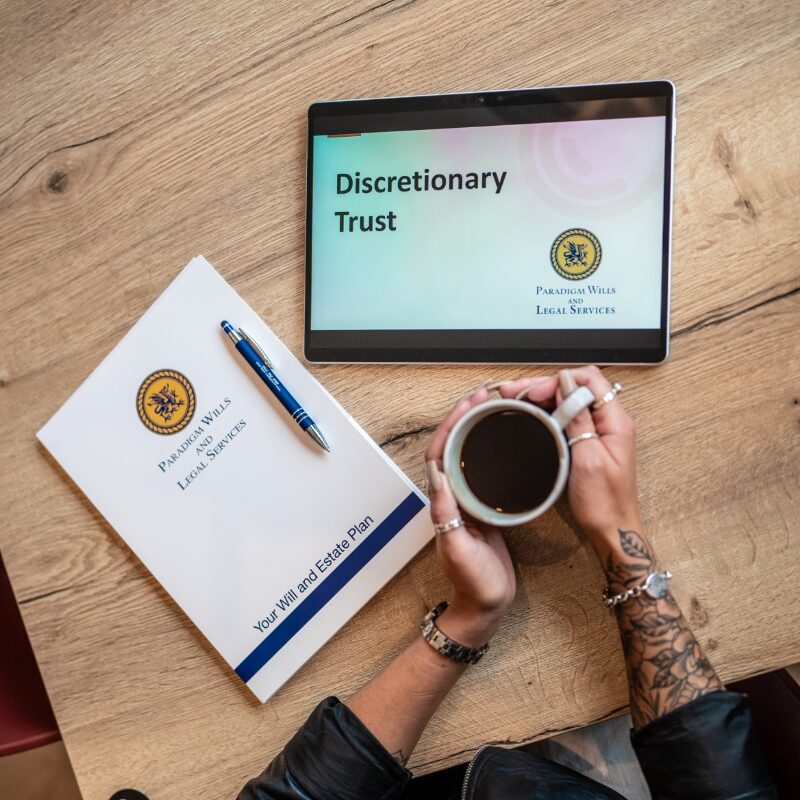

Discretionary Trust

What are the benefits?

As the settlor, you give the trustees discretion as to how, when, and for whose benefit some or all the capital and income are used.

As the settlor, you may feel it inappropriate to leave your beneficiary in control of the funds;

As well as being a very flexible form of Trust, Discretionary Trusts are also advantageous because the assets remain outside the beneficiaries’ estates for Inheritance tax purposes and are therefore not included in calculating means-tested benefits. Discretionary trust assets and income are also protected from distribution on divorce.

As well as being a very flexible form of Trust, Discretionary Trusts are also advantageous

Because the assets remain outside the beneficiaries’ estates for Inheritance tax purposes and are therefore not included in calculating means-tested benefits. Trust assets and income are also protected from distribution on divorce.

How Does It Work?

In a discretionary trust, the settlor – the person who sets up the trust – outlines general guidelines on how they wish the trust to be managed. However, the trustees have the authority to make decisions about the distribution of assets. This can be particularly useful in cases where beneficiaries’ needs may change over time, such as providing for education, health care, or other unforeseen needs.

Key Advantages

- Flexibility: Trustees can respond to beneficiaries’ changing needs, ensuring that the trust funds are used in the most effective way possible. This flexibility can provide peace of mind to the settlor, knowing that their intentions can be met even if circumstances change.

- Asset Protection: Assets held in a discretionary trust are safeguarded from creditors and legal claims against beneficiaries. This protection can be crucial for beneficiaries who might face financial difficulties or other challenges.

- Tax Efficiency: By placing assets in a discretionary trust, the settlor can potentially reduce the inheritance tax liability on their estate. This can help to preserve more of the estate’s value for future generations.

Who Should Consider a Discretionary Trust?

A discretionary trust is particularly suited for those with complex family situations or where beneficiaries’ circumstances might change over time. For example, if you have children or grandchildren with varying financial needs, or if you want to provide for future generations while retaining control over how and when funds are distributed, a discretionary trust can be an excellent solution.

With our continued support, we free you from the burden of worry and provide you with peace of mind that your assets will be inherited by your loved ones when you are no longer here.

At Paradigm Wills and Legal Services, we genuinely care about educating people on the importance of making a lasting power of attorney in Leicester. In an industry often loaded with complex legal jargon and a conveyor-belt mentality, we provide a paradigm shift in how we offer our wills services. We aim to supply fresh ideas, clear and straightforward explanations, and a service tailored specifically to you. With you at the centre, we strive to make the will writing process as transparent as possible.

Contacting us is free. Have a consultation or a home visit with one of our experts and discuss your options with no obligation.

Our team of seasoned legal advisors is always available to offer comprehensive support and expert advice. Whether you're looking to draft a will, establish a trust, navigate the complexities of applying for probate, or arrange for prepaid funeral plans, we've got you covered. Our goal is to simplify these processes for you, ensuring clarity and peace of mind every step of the way.

Get in touch

Feel free to discuss your options first with our team of will writers in Leicester. Simply fill out the form, and we will promptly reach out and assist with everything you need to get started.

Protective Property Trust

Are you a joint homeowner? Do you have concerns about who will inherit your share of the residence? Find out more about protecting yourself, your partner, and your estate.

Disabled Persons and Vulnerable Persons Trust

Do you have disabled children?

Find out more about how to provide your children with financial stability throughout their lifetime.

Flexible Life Interest Trust

Do you want to ensure that your surviving spouse will have an income for the rest of their life? Find out more about how to provide for your partner with income from the trust and avoid inheritance tax.

Asset Protection Trusts

Do you want to ensure that all your assets will ultimately pass to your children? Find out more about creating a living trust that allows you to transfer your assets or property immediately.